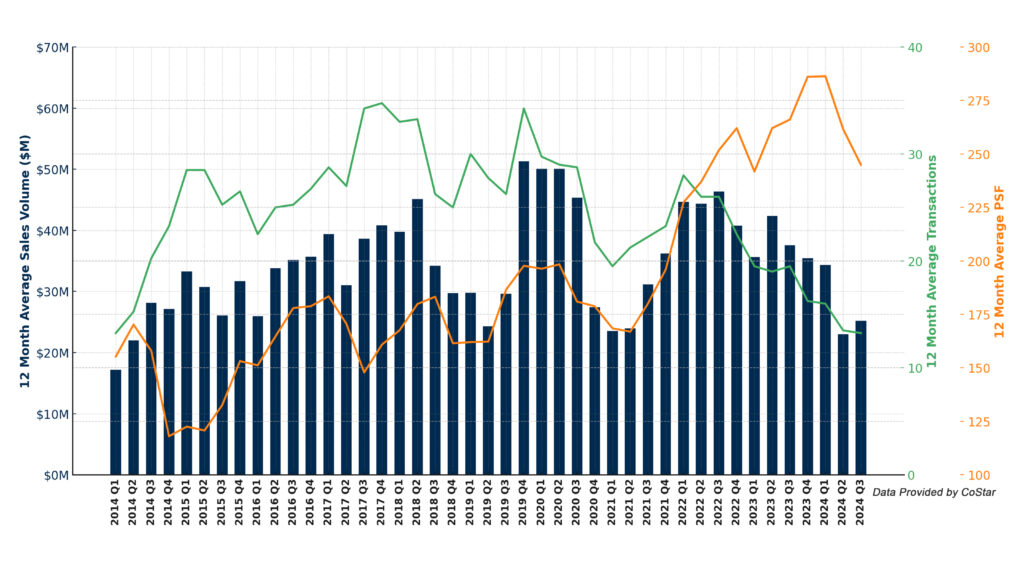

Lowest Transaction Volume in 13 Years!

In recent months, the U.S. commercial real estate (CRE) market has been grappling with significant shifts. Amid rising economic uncertainties, interest rate hikes, and changes in property demand, the industry is recording its lowest transaction volume in 13 years. While this downturn may seem daunting, it also presents opportunities for informed investors and proactive strategies.

Tracking Trends Q3 2024 – Clark County

Our latest analysis continues the discussion from our previous post tracking the 3,000 to 30,000-square-foot owner-user property market in Clark County. Since February 2024, we’ve observed a steady decrease in transaction velocity, reflecting national trends of reduced CRE activity. But what’s driving these changes?

Key Factors Shaping the CRE Market

- Economic Uncertainty: Persistent economic concerns have made investors increasingly cautious, slowing down transaction activity.

- Rising Interest Rates: Higher borrowing costs, driven by Federal Reserve policies, are making financing real estate deals less appealing.

- Shifting Property Demands: The rise in remote and hybrid work has led to a reduced appetite for traditional office spaces, significantly impacting office property transactions.

Sector-Specific Insights

The downturn isn’t uniform; each sector of the CRE market tells its own story:

- Office Properties: With high vacancy rates and demand uncertainties, office property transactions fell by 11% year-over-year.

- Multifamily Properties: Despite broader challenges, the multifamily sector showed a promising 18% increase in transactions quarter-over-quarter, hinting at stabilization.

- Retail and Industrial Properties: Retail transactions declined by 9%, while industrial properties enjoyed a modest 4% increase, reflecting their resilient demand.

What Lies Ahead?

Despite these challenges, there are glimmers of hope. As the economy stabilizes and interest rates potentially ease, we may see a recovery in transaction volumes. Yet, the pace and strength of this rebound will vary, influenced by property types and regional dynamics. Investors who stay ahead of these trends can position themselves to thrive as the market evolves.

Why This Matters for Investors

For those considering a move into the CRE market or expanding their portfolios, understanding these dynamics is essential. The complexities of the current landscape require a partner with deep market knowledge and a strategic approach. This is where we come in—our team specializes in uncovering opportunities amidst market shifts, offering tailored guidance for your investment goals.

If you’re ready to explore what these trends mean for your next commercial property transaction or want an expert’s perspective on navigating the current market, let’s connect. Whether you’re looking to buy, sell, or evaluate your portfolio, we’re here to help.

Reach out today! The future of commercial real estate is shaped by those who act with insight and purpose. Let’s make the most of these changing times together.

Sources:

1. Another ‘Meh’ Year for Commercial Property Sales – CoStar (https://www.costar.com/article/109073787/another-meh-year-for-commercial-property-sales)

2. Third-quarter property prices signal improving market – CoStar (https://www.costar.com/article/1305380979/third-quarter-property-prices-signal-improving-market)

3. Decline in Commercial Real Estate Transactions May Just Be Getting Started – CoStar (https://www.costar.com/article/190557268/decline-in-commercial-real-estate-transactions-may-just-be-getting-started)

4. Plunging Commercial Real Estate Demand Sends Prices Lower – CoStar (https://www.costar.com/article/1977034343/plunging-commercial-real-estate-demand-sends-prices-lower)

5. US Commercial Property Prices Inch Up, but Vacancy Threat Looms – CoStar (https://www.costar.com/article/2086303897/us-commercial-property-prices-inch-up-but-vacancy-threat-looms)