Will this Cycle take seven years like the Great

Recession Cycle?

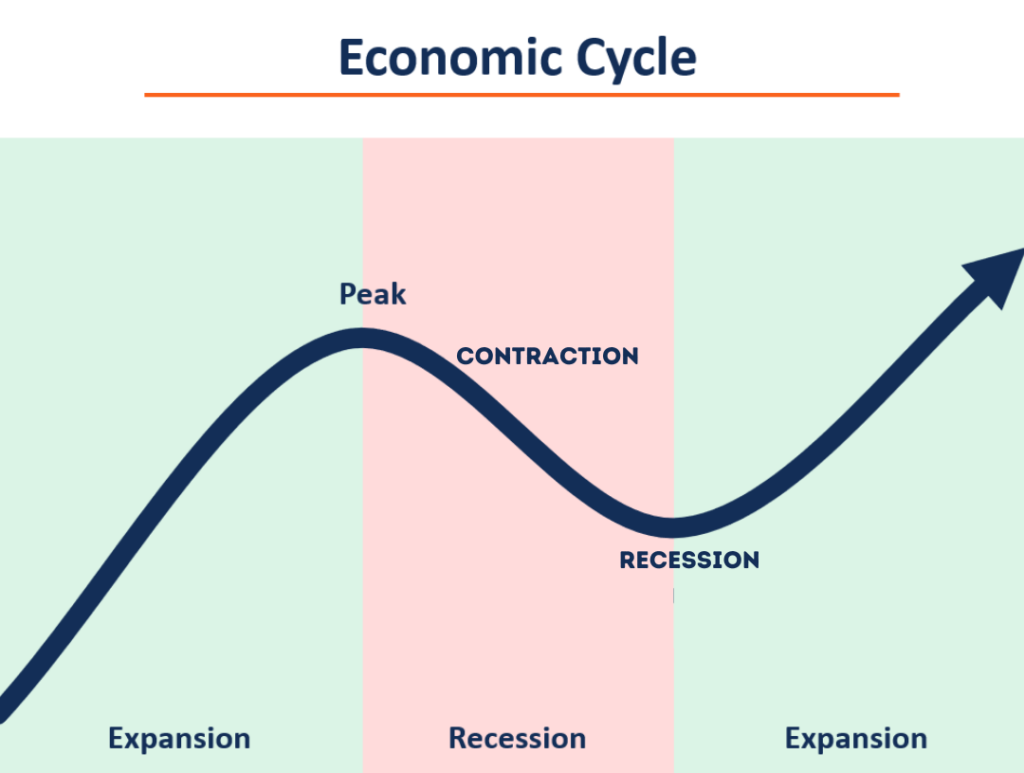

The Commercial Real Estate (CRE) market operates in a cyclical pattern and is closely tied to the broader economy. The Cycle consists of four distinct phases: Recovery, Expansion, Contraction, and Recession. Each phase presents unique challenges and opportunities for tenants, investors, developers, and Owner /Users

Recovery: Setting the Stage for Growth

The CRE market cycle typically begins with the Recovery phase. This phase is marked by an improving economy, leading to increased business activity and higher occupancy rates. As the economy gains traction, businesses expand their operations and hire more employees, driving up demand for commercial space. Consequently, landlords benefit from rising rental income and occupancy rates.

During the Recovery phase, asking rents and property sales prices start to climb. The improved market conditions attract new investors and developers eager to capitalize on the upward momentum. This boost in confidence encourages the construction of new properties, as developers anticipate securing tenants for their projects.

Expansion: A Time of Optimism and Growth

Following the Recovery phase, the market enters the Expansion phase, characterized by robust economic growth, low unemployment rates, and high consumer confidence. This phase is marked by an acceleration in demand and occupancy rates, leading to reduced vacancy levels. As a result, a wider range of investors and developers are drawn into the market.

During the Expansion phase, rental rates and property values continue to rise. With low interest rates and readily available financing options, investors and developers have the resources to fuel further growth. The market may even witness record property prices and peak annual sales velocity.

Contraction: Adapting to Changing Economic Conditions

As the market cycle progresses, the Expansion phase transitions into the Contraction phase. Economic indicators often signal a potential recession on the horizon. During this phase, interest rates begin to rise, causing demand to soften and vacancy rates to increase. Property sales prices stabilize, and transaction volumes decrease as cautious sentiment takes hold.

Asking rents may decline as businesses become more conservative, impacting the rental income for landlords. The slowdown in new construction reflects the market’s response to changing economic conditions. It’s a phase where adaptability becomes crucial for stakeholders, as they navigate the challenges brought about by shifting demand dynamics.

Recession: Weathering Economic Storms

The Recession phase is the market’s lowest point, characterized by a significant downturn in economic activity. As the broader economy experiences a sharp decline, demand for commercial properties decreases drastically. Sales prices and rental rates continue to decrease, leading to higher vacancy rates across the market.

During this phase, new construction grinds to a halt as developers face reduced demand and uncertain economic prospects. Businesses scale back operations, affecting occupancy rates, and investors face a challenging environment. However, the Recession phase also sets the stage for a potential turnaround.

The Shifting Landscape: From Recession to Recovery

Shifts in the broader economy have a profound impact on the CRE market cycle. When the economy begins to recover, marked by declining interest rates, lower vacancy rates, increased transaction volumes, and a resurgence in new construction, the market enters the Recovery phase once again. This signals the end of the downturn and the start of a new cycle.

The key going forward is determining what phase we are in, are we at a transition point from expansion contraction and what might we see over the next few years. Clark County of course feels the impacts of the National economy, but also seems to be experiencing a critical mass of commercial real estate activity that is keeping our market moving forward.

As we’ve mentioned before this is due to a strong state economy, forty-year national and international marketing efforts by the CREDC, Visit Vancouver, all out local Ports and Cities to attract visitors, and growing companies.