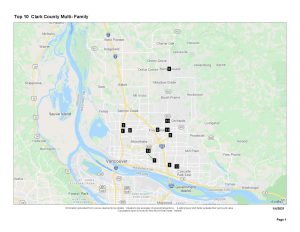

This headline is a bit misleading, as you’ll notice there are actually thirteen transactions on this list. I’ve included a couple extra; three transactions had the same owner and illustrate the ongoing maturing of the Clark County market as a very attractive environment for investment dollars.

We all know COVID has had a huge impact on retail sales across the country. We felt it here in Clark County. Commercial transactions were definitely down in 2020, vs 2019, but there were still significant properties that changed hands. Two retail centers and a pharmacy led the way, each topping the six-million-dollar mark.

The Walgreens located on Andresen, adjacent to the Living Hope Church, is a 14,800 square foot building that was built in 2006. It closed in March, just as COVID emerged, and topped the list of sales in terms of cost per square foot at $421.73. It will basically provide its investor with a 5.83% percent cash flow return on a long-term lease.

One of the two retail centers, closing in the 4th quarter, was Cascade Market Place. Located right in the heart of Cascade Park, a 29,000 square foot development built in 1986 and long-time home to Safeway. It sold for $225.93 a square foot, with a projected return rate of 6.42 %.

After many years, the property at 11696 NE 76th Street (Orchards Plaza) had attracted Big Lots as a tenant. You may recall, it was a Safeway store as well for many years, closing during the height of the Great Recession just as several other grocery stores changed and consolidated their operations. Safeway Corporation itself was the seller in this transaction and we find this development, 48,637 square feet, commanded a much lower price per square foot at $125.53.

The transaction at 5 Corners Mall, at the intersection of 94th and 9314 76th Street, is the oldest of these properties, built in 1973. It consists of over 60,000 square feet of rentable space and the closing price, at $81 a square foot, was definitely the lowest of our group. Acquired by a local development and construction company, my bet is we’ll see significant upgrades to the property and a transition in tenant base as the owners try to attract the new residents that have settled in the area over the past 5 years.

The transaction at 5 Corners Mall, at the intersection of 94th and 9314 76th Street, is the oldest of these properties, built in 1973. It consists of over 60,000 square feet of rentable space and the closing price, at $81 a square foot, was definitely the lowest of our group. Acquired by a local development and construction company, my bet is we’ll see significant upgrades to the property and a transition in tenant base as the owners try to attract the new residents that have settled in the area over the past 5 years.

Battle Ground appears on the list as well, with Battle Ground Corner changing hands. Adjacent to the Jack-In-The-Box and South of Fred Meyer, this strip- center includes national brand tenants like Starbucks, Domino’s and H&R Block. Located at the hugely busy intersection of SR503 and SR502, the sale topped $4.8 million, almost reaching $400 a square foot. It’s listed as providing a return of 5.3 %.

Out on 78th, an iconic Clark County property the Bingo Hall closed its sale in October. It sold for just under $4 million dollars, at a per square foot cost of $166.74. This property also seems destined for updating and repurposing by a local investor.

Another Hazel Dell property, this one on Highway 99 on the NE corner of 88th Street, had been a long slow struggle to lease up. Built in 2008, it was an example of a nice building still suffering from some retail fallout of the Great Recession. The past couple of years, it has gradually filled then sold in May for $3,150,000, at $266.14 a square foot and a 7.12% return rate.

Another Hazel Dell property, this one on Highway 99 on the NE corner of 88th Street, had been a long slow struggle to lease up. Built in 2008, it was an example of a nice building still suffering from some retail fallout of the Great Recession. The past couple of years, it has gradually filled then sold in May for $3,150,000, at $266.14 a square foot and a 7.12% return rate.

Three properties, #9 , #12 & # 13 were sold by one owner based on having Caliber Collision, a 1,000-shop national chain with presence in 37 states, as long-term lease tenants. This is symbolic of the continuing evolution of Clark County as a commercial real estate market. There is more quality NNN investment product available, and being created each year. You may recall, these stores were owned by Alpine Auto Body, operated by local businessman Rod Cook and his wife Jane for many years. A great example of how a local owner / operator if they own their commercial property can generate more wealth. Locations in Cascade Park , Orchards, and Hazel all very similar in cost per square foot. Each sold for close to $3 million. Expected returns between 6.0 % and 7%.

Even with the storm clouds of Covid , we see, the health and vitality of Clark County’s commercial market rebounding in many significant ways.

Development may have slowed, but even the eye test driving around the County you can see signs of strength .

Top Ten Retail Transactions for 2020 (click to enlarge)